Does Home Insurance Cover Garage Door Repair?

TLDR;

Yes, home insurance typically covers

garage door repairs if the damage is caused by a covered event like fire, theft, vandalism, or a vehicle accident. However, it won’t cover issues stemming from normal wear and tear, poor maintenance, or excluded natural disasters like flooding.

Understanding Homeowners Insurance and Garage Door Coverage

Homeowners insurance is designed to protect your property from unexpected losses and damages.

Your garage door is often included under this protection—especially if it's attached to your home.

Key points to understand:

- Attached garage doors usually fall under

dwelling protection.

- Detached garages may fall under

“other structures” coverage in your policy.

- Insurance may only cover the

structure, not necessarily

mechanical parts like openers unless specifically noted.

Most standard policies (like HO-3 or HO-5) will include this coverage, but the exact terms vary depending on the provider.

Is a Garage Door Covered by Home Insurance?

If you're asking, does home insurance cover garage door repair, the answer depends on how the damage happened.

Common covered scenarios:

- Your car accidentally hits the garage door

- Vandalism or burglary

- A tree or branch falls during a storm

- Fire or lightning damage

Uncovered situations may include:

- Gradual wear and tear

- Rust or corrosion

- Rot or mold

- Improper installation or poor maintenance

Always check your

specific policy details for any exclusions or limits.

What Type of Garage Door Damage Is Covered by Insurance?

To make things easier, let’s break it down.

Covered Damage Examples:

- Vehicle Impact (accidental): You hit your own garage door? Your

auto insurance may not help, but your

home insurance might.

- Vandalism: Someone spray-painted or kicked in your garage door.

- Storm-Related: Hail, strong winds, or a fallen tree damaged the door.

- Fire or Smoke: Covered under most policies with dwelling protection.

Not Covered:

- Old or Worn Out Doors: Deterioration over time isn’t covered.

- Mechanical Failure: Broken springs or motors? Usually excluded.

- Negligence: Skipping basic maintenance may void coverage.

- Flood or Earthquake: Usually excluded unless you added special coverage.

How to File a Home Insurance Claim for Garage Door Repair

If your garage door was damaged by a covered event, here’s how to handle the claim with your insurer.

Step-by-step Claim Process:

- Document the Damage

- Take clear photos from multiple angles.

- Note the date and cause of the damage.

- Review Your Policy

- Look at the “dwelling” or “other structures” section.

- Check your deductible and coverage limits.

- Call Your Insurance Company

- Provide all the details.

- Be clear and honest in your report.

- Meet with the Adjuster

- They’ll inspect the damage.

- Offer supporting documents like repair estimates.

- Get Repair Estimates

- Smart Garage Door can provide reliable and prompt estimates if you're unsure about the

cost to fix garage door damage before submitting your claim.

- Make sure the contractor is

approved or

licensed as required by your insurer.

- Understand Your Payout

- You may receive

actual cash value (less depreciation) or

replacement cost depending on your policy.

- Keep Records

- Save emails, call logs, and documents related to the claim.

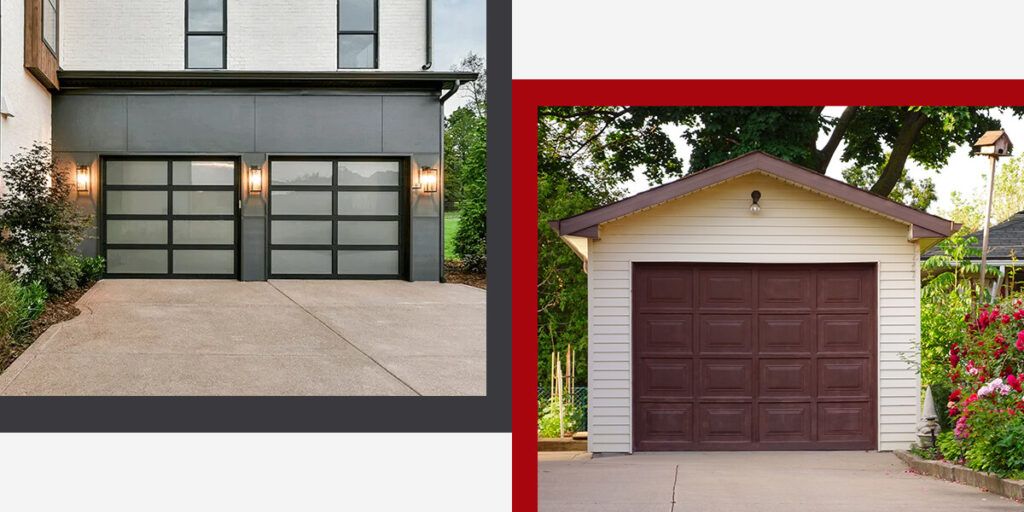

Attached Garage vs. Detached Garage: What’s the Difference?

Your garage door coverage may vary depending on the type of garage:

Attached Garage

- Usually covered under

dwelling protection.

- Damage may be handled like any other part of the home.

Detached Garage

- Covered under the

“other structures” clause.

- Coverage limit may be

10% of your home’s insured value.

- You may need to

add extra coverage if the garage is large or contains expensive equipment.

Tip: Always verify this section in your policy. Many homeowners overlook it.

The Truth Insurance Companies Don’t Always Tell You

There are a few caveats to keep in mind when you’re filing claims.

Things insurers might not emphasize:

- Fine Print Loopholes: Some policies exclude certain perils like floods or earthquakes unless added.

- Depreciation: If you don’t have replacement cost coverage, you’ll only get what the door is worth today.

- Negligence: Claims can be denied if you didn’t maintain the door.

- Bundled Claims: Filing multiple claims in a short span can raise your premium—or result in policy cancellation.

Advice from

Smart Garage Door: Always read the full policy. Don’t assume something’s covered just because it seems like it should be.

How to Maintain a Garage Door and Prevent Future Claims

Preventive maintenance is your best defense against uncovered damage.

Garage Door Preventive Maintenance Checklist:

- Lubricate moving parts (rollers, springs, hinges) every 6 months

- Inspect weatherstripping for cracks or gaps

- Check tracks and alignment to avoid mechanical stress and

Uneven Garage Door issues

- Test safety sensors monthly

- Keep debris away from tracks and rollers

- Look for rust, mold, or signs of wear

Another proactive step is choosing the right garage door from the start, one that suits your climate, usage habits, and insulation needs. A properly selected door is less likely to suffer damage from wear and tear, reducing the chances of future claims.

Keep

records of professional inspections or repairs. They help during claim reviews to prove due diligence.

Garage Door Insurance Tips to Maximize Your Coverage

Want to make sure your next claim goes smoothly? Here’s how:

- Review your policy yearly with an insurance advisor.

- Request a policy upgrade to include replacement cost instead of actual cash value.

- Ask about endorsements for detached garages, valuable tools, or smart openers.

- Bundle your home and auto insurance to potentially increase benefits or streamline claims.

- Work with trusted contractors like Smart Garage Door for certified repairs and installations.

FAQs About Garage Door Insurance Coverage

Does home insurance cover damage caused by my car?

Yes—if it was accidental and the garage is part of your home. However, your auto insurance may also be involved depending on the situation.

Are garage door openers covered?

Usually not, unless your policy explicitly mentions it. Most policies only cover structural damage, not electrical or mechanical failures.

Will insurance pay for a new garage door?

Only if the damage is from a covered peril. They won’t replace it due to old age or cosmetic flaws.

Can I choose my own repair company?

Yes—but the company may need to meet the insurer’s standards. Smart Garage Door is experienced in working with insurance providers and can guide you through the process.

Review Your Homeowners Insurance Policy Before You File a Claim

Before you make that call to your insurance company, take a step back:

- Review your policy documents in full.

- Know your deductibles and exclusions.

- Consult your insurance provider if you’re unsure.